closed end loan examples

Is offered by a lender only when the borrower provides collateral for the loan. You borrow money for a specific purpose such as paying for a car or house and then you make monthly payments until its paid off.

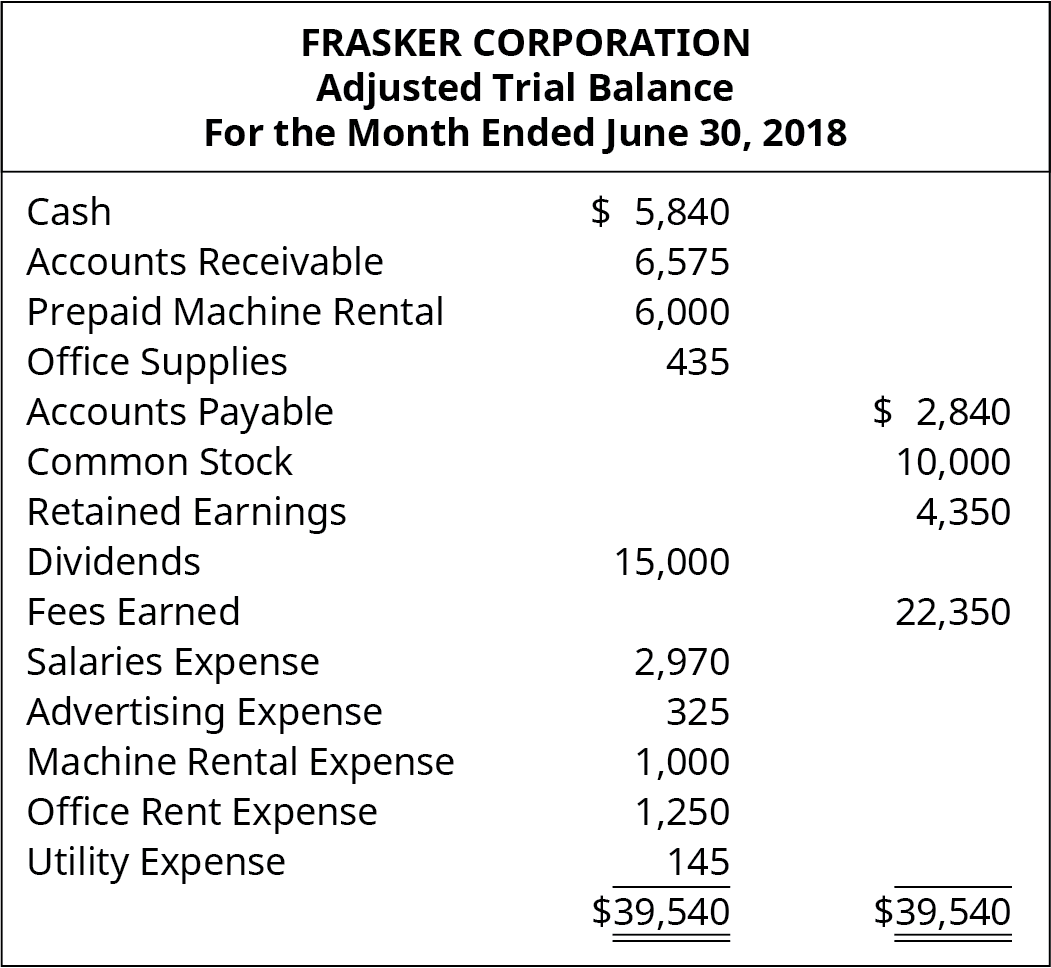

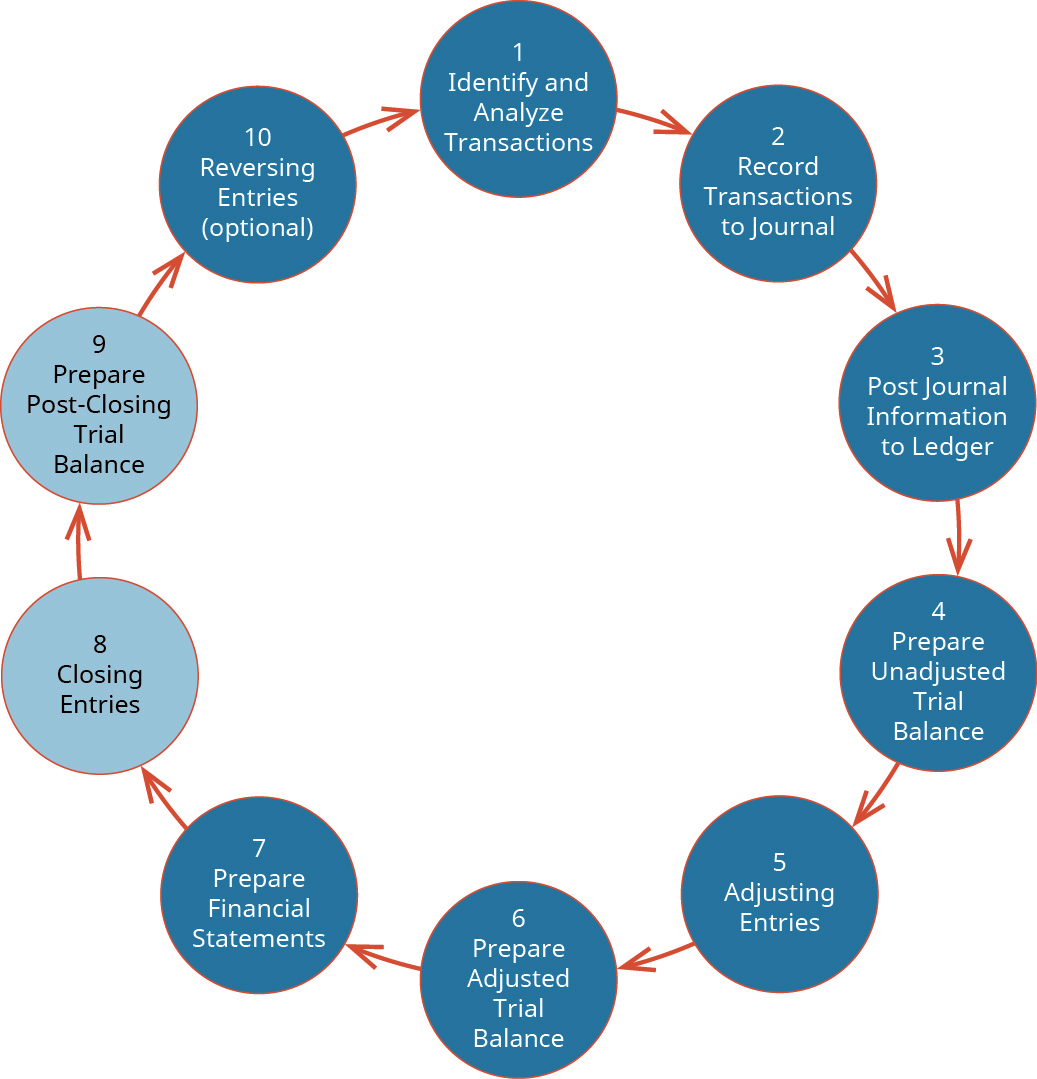

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

Open-end credit on the other hand is revolving credit that allows you to continually access money as you make payments and only pay interest on what you use.

. You take 10000 on an open-end loan. Payments on a Closed-End Loan. When you borrow money you make.

Open-end revolving lines of credit include amounts available to a borrower up to a preset credit limit for a specified amount of time. Payments are usually of equal amounts. 60 monthly payments of 3025 per 1000 borrowed These examples can be incorporated into the body of the advertisement or reference in the disclosures.

An example of closed end credit is a car loan. If you take out an installment loan such as an auto loan this is a form of closed-end credit with a fixed interest rate and payment. Closed End Credit Examples.

You use 8000 of it repay 5000 of it in the next couple of months 21. Loan agreement3 Examples of closed-end installment loans include mortgage loans and auto loans. Closed - end credit is used for a specific purpose for a specific amount and for a specific period of time.

Why It Is Important. How Open-End Credit Works. A closed-end loan is also known as an installment loan by traditional lenders.

RV loans up to 108 months. Another source of credit is credit card companies like visa mastercard American express and discover. Open-End Loan Real Estate Agent Directory.

A closed-end mortgage also known simply as a closed mortgage is one of the more restrictive home loans you can get. These loans are normally disbursed all at once in order for the debtor to buy or achieve a specific thing and often the creditor gains rights to possess the item if the debtor fails to repay the loan. An agreement or contract lists the repayment terms such as the number of payments the payment amount and how much the credit will cost.

Examples of closed-end loans. As mentioned above a 48-month personal loan of 5000 featuring a 12 annual percentage rate of interest is a closed-end credit example. H-17B Debt Suspension Sample.

Unsecured Closed End Credit. Mortgages auto payments and student loans are the most common. Auto loans student loans and mortgages.

H-14 Variable-Rate Mortgage Sample 102619b H-15 Closed-End Graduated-Payment Transaction Sample. Payments are usually of equal amounts. The prearranged 48-month repayment schedule in this case would require the borrower to pay 13167 every month and about 6320 over the life of the loan.

Closed-end loans are probably what you think of when you imagine a traditional loan. Closed end credit has a set payment amount every month. With this type of loan you cant.

For a 25000 auto loan for a term of 60 months with a 275 APR the monthly payment will be _____ A repayment example may also be stated as a unit cost. H-13 Closed-End Transaction With Demand Feature Sample. Closed-end loans are installment loans.

They have a set interest rate usually determined by the credit score and other financial information provided on the loan application. Closed end credit is a loan for a stated amount that must be repaid in full by a certain date. 36 to 72 month auto loans.

Mortgage loans and automobile loans are examples of closed - end credit. Generally with closed-end credit the seller retains some form of control over the ownership title to the goods until all. H-11 Installment Loan Sample.

So if a borrower is 15 years into a 30-year closed-end. A closed-end loan is to be contrasted with an open-ended loan where the debtor borrows multiple times without a specified repayment date like with a credit card. 10 20 or 30 year mortgages.

Personal loans are also often close-end. A closed-end mortgage loan or an open-end line of credit to improve a multifamily dwelling used for residential and commercial purposes for example a building containing apartment units and retail space or the real property on which such a dwelling is located is a home improvement loan if the loans proceeds are used either to improve the entire property for example to replace the. Lets give an example of an open-end loan.

There are a few common ways you may use closed end credit such as. For example a car company will have a lien on the car until the car loan is paid in full. Only 300 origination fee.

Examples Examples of closed-end loans typically appear in installment loans. For example closed-end mortgages restrict the borrower from using the home equity they have built as collateral for additional financing. For example if an open-end credit account ceases to be exempt A closed-end loan is exempt under 10263b unless the extension of credit is secured 22.

Mortgage loans and automobile loans are examples of closed-end credit. When you borrow money with a closed-end loan you are agreeing to make installment payments which include principle and interest divided in equal amounts and applied to a repayment schedule. Balances may be drawn or paid down at any time at the borrowers option.

An example of a closed-end loan is a mortgage loan. Also Know what are the three most common types of closed. H-17A Debt Suspension Model Clause.

/balloon-loans-315594-cadd06e3bbe046d39311cd4be59d794c.gif)

How Balloon Loans Work 3 Ways To Make The Payment

Truth In Lending Act Tila Consumer Rights Protections

A Complete Guide To Investment Vehicles Money For The Rest Of Us

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

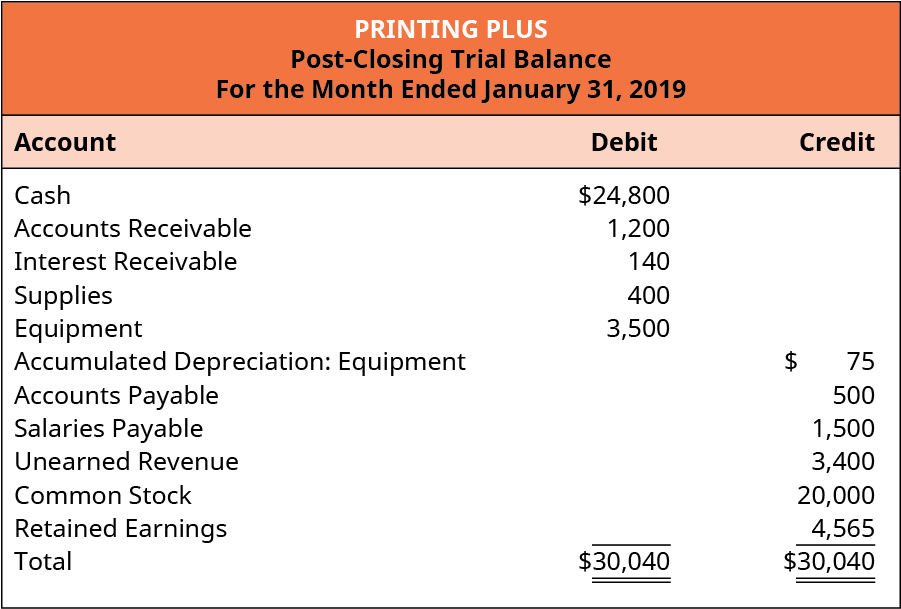

Prepare A Post Closing Trial Balance Principles Of Accounting Volume 1 Financial Accounting

What Is Open End Credit Experian

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

What Is A Closed End Fund And Should You Invest In One Nerdwallet

Loan Vs Mortgage Difference And Comparison Diffen

What Are Closed End Funds Fidelity

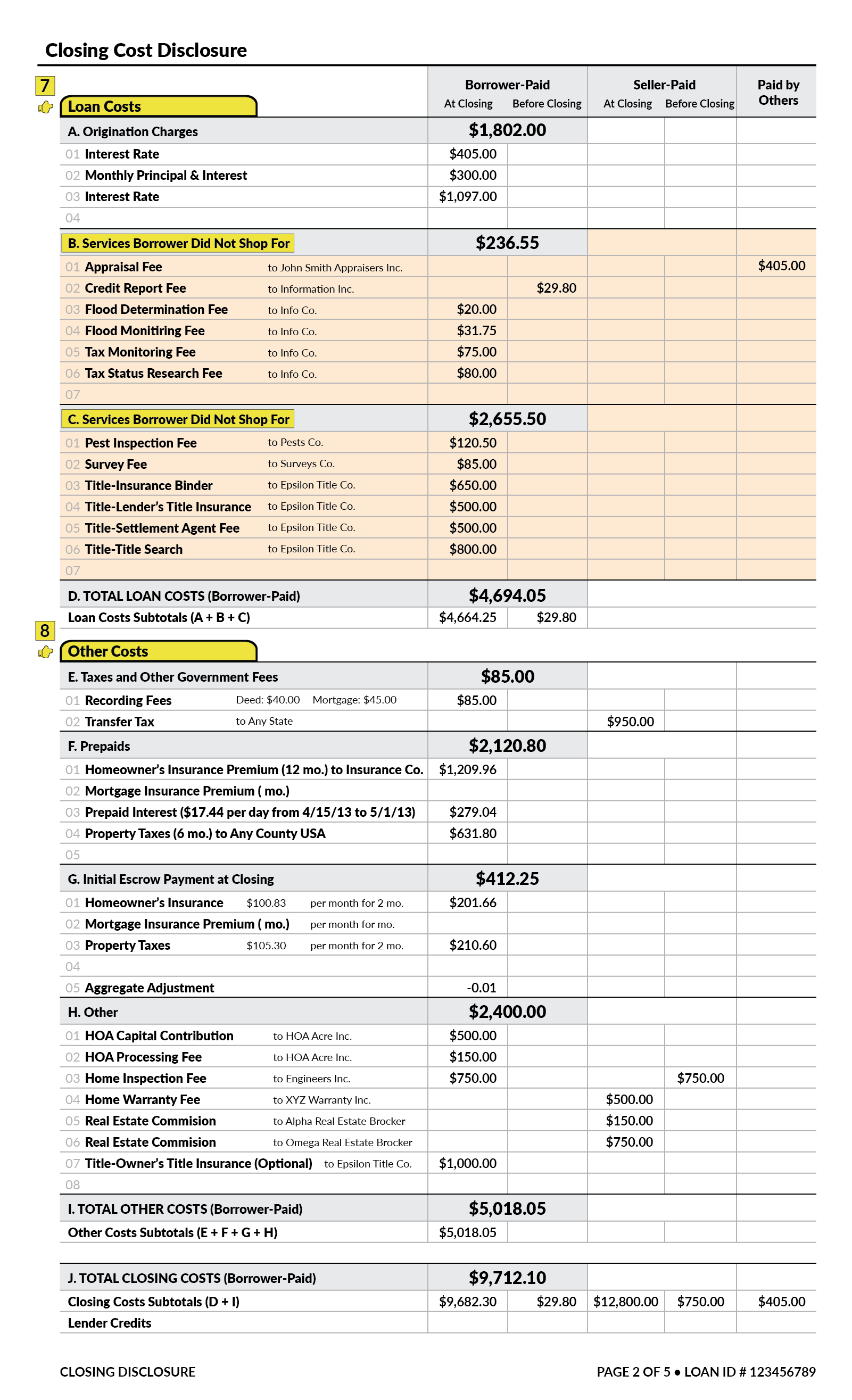

What Is A Closing Disclosure Lendingtree

Understanding Finance Charges For Closed End Credit

Adjusting Entries For Liability Accounts Accountingcoach

/155571944-5bfc2b9646e0fb005144dd3f.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)